The real estate market is complex, but a Comparative Market Analysis simplifies it. This essential tool provides the data-driven clarity needed to price, offer, and negotiate with absolute confidence.

A Comparative Market Analysis (CMA) is an expert evaluation of a home’s value based on similar, recently sold properties (comps). This guide explores the CMA process, its strategic advantages for both buyers and sellers, and how it differs from a formal bank appraisal.

What Is a Comparative Market Analysis and Why Does It Matter?

In the fast-paced world of real estate, “guessing” a home’s value is a recipe for financial disaster. Whether you are a homeowner looking to list or a buyer ready to make an offer, you need a benchmark. That benchmark is the Comparative Market Analysis.

A Comparative Market Analysis is a report prepared by a real estate professional that examines the prices of similar properties in the same area that have recently sold, are currently active, or were previously listed but expired. It is the “gold standard” for determining a competitive price point in any market condition.

The Core Components of a CMA

To understand how a Comparative Market Analysis works, one must look at the “Comps” (comparables). These are properties that share similar characteristics with the “Subject Property.”

1. Evaluate the Subject Property

The CMA process begins by analyzing the subject property in detail. A real estate agent reviews square footage, bedroom and bathroom count, overall condition, and any recent upgrades. Features such as modern kitchens, smart home technology, or energy-efficient improvements also influence value. This evaluation establishes a baseline price and highlights how the home compares with similar properties in the local market, forming the foundation for accurate and competitive pricing.

2. Search for Comparables

Next, agents locate three to five comparable homes that have sold within the last three to six months. These properties should be nearby and similar in size, layout, and condition—ideally within the same neighborhood. Recent sales offer the clearest snapshot of buyer demand and market trends. By studying these comps, agents can identify realistic price ranges and understand how current listings are performing in today’s competitive real estate environment.

3. Adjust for Differences

Because every home is unique, pricing adjustments are made to reflect key differences between the subject property and its comparables. If a comp includes upgrades like a finished basement, extra bedroom, or larger yard, its price is adjusted accordingly. These refinements help balance out variations and estimate a fair market value. This step ensures the CMA reflects what buyers would realistically pay based on features, condition, and location.

Why a CMA Is Valuable for Your Strategy

A Comparative Market Analysis plays a critical role in building a successful real estate strategy because it replaces guesswork with real market data. For sellers, a CMA helps determine the ideal listing price by analyzing recent sales, active listings, and local trends—reducing the risk of overpricing or underselling. For buyers, it provides a clear picture of fair market value, making it easier to submit confident, data-backed offers. Beyond pricing, a CMA reveals market momentum, showing whether conditions favor buyers or sellers. It also highlights competitive advantages, such as upgrades or location benefits, that can strengthen negotiations. By grounding decisions in accurate comparisons, a CMA minimizes emotional choices, improves timing, and increases the likelihood of a smooth transaction. Ultimately, this data-driven approach protects your investment and helps achieve better outcomes in any market condition.

For Sellers: Pricing to Win

Using a Comparative Market Analysis prevents the two biggest mistakes in selling: overpricing and underpricing. Overpricing leads to “stale” listings that eventually require price drops, which can signal desperation to buyers. Underpricing, while it may lead to a quick sale, leaves your hard-earned equity on the table.

For Buyers: Making a Data-Backed Offer

In a “seller’s market,” emotions run high. A Comparative Market Analysis acts as a reality check. It helps you see if the asking price is justified by recent data or if the seller is simply testing the limits of the market. This is a crucial part of Brand Perception in Marketing for a listing; if the data doesn’t support the price, the “brand” of that home suffers.

How Buyers and Sellers Can Use CMA Data to Win Negotiations

A Comparative Market Analysis isn’t just about setting a price—it’s a powerful negotiation tool that gives both buyers and sellers a clear advantage. By relying on real market data instead of emotions, CMA insights help guide smarter decisions throughout the transaction. Sellers can use CMA findings to justify their asking price, highlight strengths that outperform comparable homes, and confidently respond to buyer objections. Buyers, on the other hand, can reference recent sales to support fair offers, avoid overpaying, and identify overpriced listings. CMA data also reveals market momentum, showing whether buyers or sellers currently hold leverage. This evidence-based approach reduces guesswork, builds credibility during discussions, and creates a stronger foundation for compromise. Ultimately, using CMA strategically leads to smoother negotiations, fewer surprises, and better financial outcomes for everyone involved in the deal.

For Sellers: Turning CMA Insights Into Higher Returns

- Set a competitive listing price to attract serious buyers quickly

- Highlight features that outperform comparable homes

- Anticipate buyer objections using expired listings

- Avoid unnecessary price reductions by starting correctly

For Buyers: Making Smarter, Confident Offers

- Identify overpriced properties instantly

- Support your offer with hard data during negotiations

- Avoid bidding wars on homes already above market value

- Spot undervalued opportunities before others do

CMA Strategy Comparison

| Role | CMA Purpose | Key Benefit |

|---|---|---|

| Seller | Optimize listing price | Faster sale + maximum equity |

| Buyer | Validate offer price | Prevent overpaying |

| Investor | Identify value gaps | Higher ROI potential |

| FSBO Owner | Avoid pricing mistakes | Increased buyer trust |

Using CMA data transforms negotiations from emotional guessing into evidence-based decision-making—giving both parties clarity and leverage.

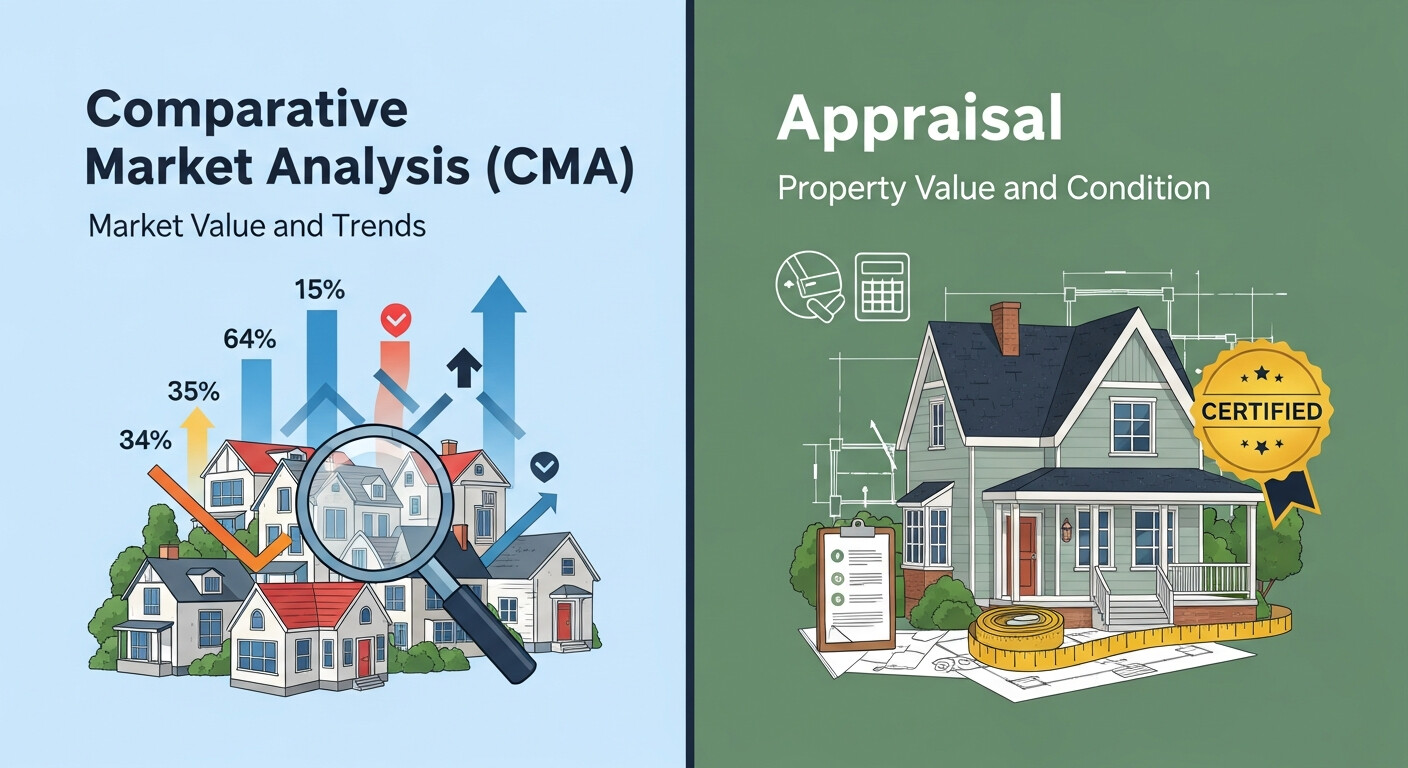

Comparative Market Analysis vs. Appraisal

It is a common misconception that a CMA and an appraisal are the same. While both seek to find value, their purposes and practitioners differ.

| Feature | Comparative Market Analysis | Professional Appraisal |

| Performed By | Real Estate Agent/Broker | Licensed/Certified Appraiser |

| Primary Goal | Determine listing or offer price | Support a mortgage loan |

| Cost | Usually Free (part of service) | $400 – $600+ |

| Detail Level | Focused on market trends | Technical & structural audit |

For deeper insights into how data affects value, advanced marketers sometimes use tools like Google Analytics to track interest in specific neighborhoods, though the appraisal remains the legal standard for lenders.

The “Science” of Market Trends

A great Comparative Market Analysis doesn’t just look at the past; it looks at the present and future. Agents incorporate Trend Marketing AI Data Strategy to understand where the market is heading.

- Supply and Demand: If inventory is low, the CMA might suggest a slightly higher “aggressive” price.

- Local Economics: Are new tech hubs moving into the city? This drives Brand Awareness for the neighborhood, increasing values.

- Seasonal Trends: Selling in the spring often yields higher results than mid-winter.

Advanced Analytics in Modern Real Estate

Today, real estate isn’t just about yard signs; it’s about Digital Marketing Analytics. When an agent presents a CMA, they are essentially performing a Competitive Brand Analysis on your home.

They might use Video Analytics Market Trends to see how virtual tours are impacting sale prices or Customer Journey Mapping to see how buyers find homes in your specific zip code. By Measuring SEO Success for a listing, agents ensure the home appears where the “Comps” appeared.

How to Get an Accurate CMA

To ensure your Comparative Market Analysis is reliable, follow these steps:

1. Partner with a Local Expert

Working with a local real estate expert gives you a powerful advantage. Unlike automated pricing tools, experienced agents understand neighborhood trends, buyer behavior, and even street-by-street differences. Their firsthand knowledge helps you price accurately, highlight your home’s strongest features, and avoid costly mistakes—ultimately leading to faster sales and stronger negotiations.

2. Be Transparent

Honesty builds trust and speeds up transactions. Always disclose known issues, repairs, and recent upgrades to potential buyers. Transparency prevents surprises during inspections and reduces the risk of deals falling apart. When buyers feel informed and confident, they’re more likely to move forward quickly and submit serious offers.

3. Review the “Expireds.”

Expired listings—homes that failed to sell—offer valuable market insight. Study these properties to understand common pricing errors, presentation mistakes, or location challenges. They clearly show what buyers rejected, helping you avoid similar pitfalls. Learning from expired listings allows you to position your property competitively and attract motivated buyers.

Conclusion

A Comparative Market Analysis is more than just a list of prices; it is your roadmap to a successful real estate transaction. By anchoring your decisions in hard data rather than emotion, you protect your investment and gain a significant edge in negotiations. Don’t fly blind—always insist on a comprehensive CMA before making your next move.

Frequently Asked Questions

1. Is a Comparative Market Analysis the same as an assessment?

No. A tax assessment is conducted by local municipalities for property tax purposes and usually doesn’t represent true market value. A Comparative Market Analysis (CMA) estimates what buyers are currently willing to pay by reviewing similar recently sold homes. Because it relies on real-time market data and local trends, a CMA offers a far more accurate snapshot of your property’s actual selling potential.

2. Can I do my own Comparative Market Analysis?

You can research comparable homes using public real estate websites, but without MLS access and professional pricing expertise, your results may be inaccurate. Real estate agents adjust for location, upgrades, square footage, and condition—details most DIY CMAs overlook. For precise pricing and reliable market insights, working with a licensed real estate professional is strongly recommended.

3. How many “Comps” should be in a report?

A standard CMA typically includes three recently sold homes and three active listings. Sold properties reflect real market value, while active listings show current competition. Together, they provide a balanced perspective on pricing trends and buyer demand, helping sellers set realistic expectations and make smarter pricing decisions.

4. What happens if the CMA and appraisal don’t match?

This is common. A CMA helps guide marketing and pricing strategy, while an appraisal protects the lender by assessing risk. If the appraisal comes in lower than the CMA, buyers and sellers may need to renegotiate, lower the price, or explore alternative financing options to keep the transaction moving forward.

5. Does a CMA include “Pending” sales?

Yes. Pending sales reveal the most recent buyer activity and help indicate where the market is heading. Although final sale prices aren’t available until closing, these listings offer valuable insight into demand, competition, and emerging pricing trends, making them an important part of a comprehensive CMA.

6. How long is a Comparative Market Analysis valid?

In rapidly changing markets, a CMA is typically accurate for about 30 to 60 days. After that, shifts in inventory levels, interest rates, or buyer behavior can significantly impact home values. For best results, sellers should request an updated CMA if pricing decisions are delayed.

7. Why do agents provide CMAs for free?

Many agents offer CMAs as part of their brand positioning strategy. It allows them to demonstrate expertise, build trust, and provide value before any contract is signed. This upfront service helps potential clients make informed decisions while showcasing the agent’s knowledge of the local market.

8. Do upgrades always increase the value in a CMA?

Not necessarily. While upgrades can improve appeal, they don’t always deliver full return on investment. For example, a $50,000 pool might only add $20,000 in market value depending on neighborhood preferences. Buyer demand and local norms ultimately determine how much upgrades contribute to pricing.

9. Can a CMA help in a FSBO situation?

Yes. For Sale By Owner (FSBO) sellers can benefit greatly from commissioning a CMA to avoid overpricing or underselling their property. Even paying a small fee for professional guidance can prevent costly mistakes, attract serious buyers, and speed up the selling process.

10. How does a CMA handle “unique” properties?

When direct comparables aren’t available, agents expand the search area or analyze homes with similar luxury or niche features. Using specialized valuation methods and marketing strategies, they apply adjustments to estimate value accurately, ensuring even unique properties receive fair and data-driven pricing.